Journal Articles

International determinants of asymmetric dependence in investment returns

Journal of International Money and Finance, Volume 122, April 2022

Abstract: International investors require additional compensation, charged on top of the systematic risk premium, to hold assets displaying asymmetric dependence in returns. We document that the degree and pricing of asymmetric dependence differs substantially across the 38 markets examined. Asymmetric dependence strengthens in fast-developing equity markets. We propose policy actions aimed at improving firm competition levels through reducing restrictions for new firms to enter financial markets, which may help stabilize markets and reduce conditional risk levels of equities during downturn events.Presented at: 2018 FMA Europe, 30th AFBC, 2017 FIRN Annual Conference, 2017 FMA, 2017 Fordham PhD Colloquium.

Asymmetric Dependence in Real Estate Investment Trusts: An Asset-Pricing Analysis

Journal of Real Estate Finance and Economics, Volume 56, Issue 2 Page 183-216, February 2018

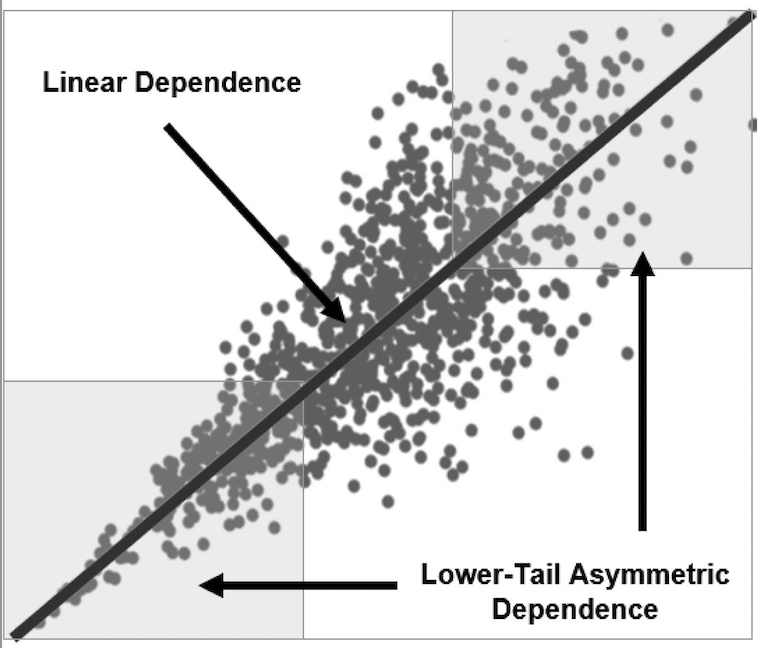

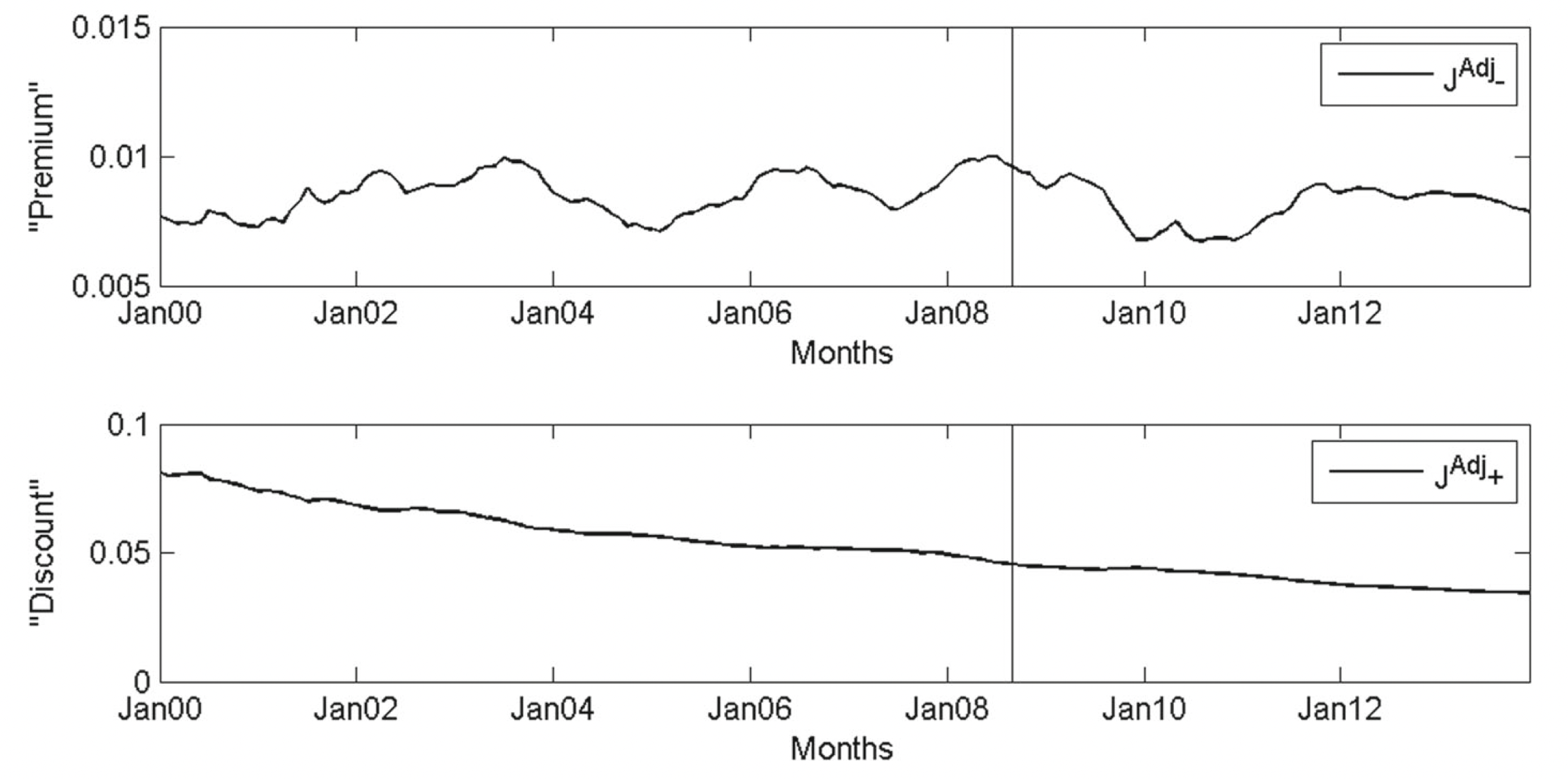

Abstract: REITs are often assumed to be defensive assets having a low correlation with market returns. However, this dependence is not symmetric across the joint-return distribution. Disappointment-averse investors with state-dependent preferences attach (dis-)utility to investments exhibiting (lower-tail) upper-tail asymmetric dependence. We find strong empirical evidence that investors price this asymmetric dependence in the cross section of US REIT returns. In particular, we show that REIT stocks with lower-tail asymmetric dependence attract a risk premium averaging 1.3% p.a. and REIT stocks exhibiting upper-tail asymmetric dependence are traded at discount averaging 5.8% p.a. We find no evidence that the equity β is positively priced in US REIT returns. Our findings imply that traditional estimators of REIT cost of capital and performance measurement are likely to be substantially misrepresentative.Presented at: 3rd ERES Annual Conference, 2016 Auckland Finance Meeting.